How VAT works and is collected (valueadded tax) Novashare

If you are a business owner in the UK, your VAT registration number is a unique identifier that your business receives from the HMRC. The format of the UK VAT number always complies with the following two rules: It contains 9 digits. It starts with the prefix GB. If you work with partners or suppliers in mainland Europe, you may notice that.

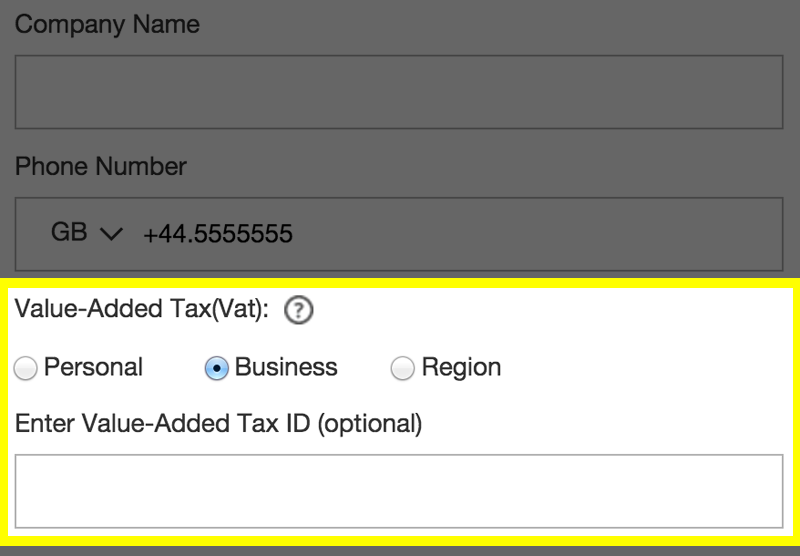

Add Your VAT ID

18 December 2020 — See all updates Get emails about this page Print this page Overview These details will help you to complete an EC Sales List. They include: EU country codes VAT number formats.

VAT Services Accountancy Services MBL Accounting

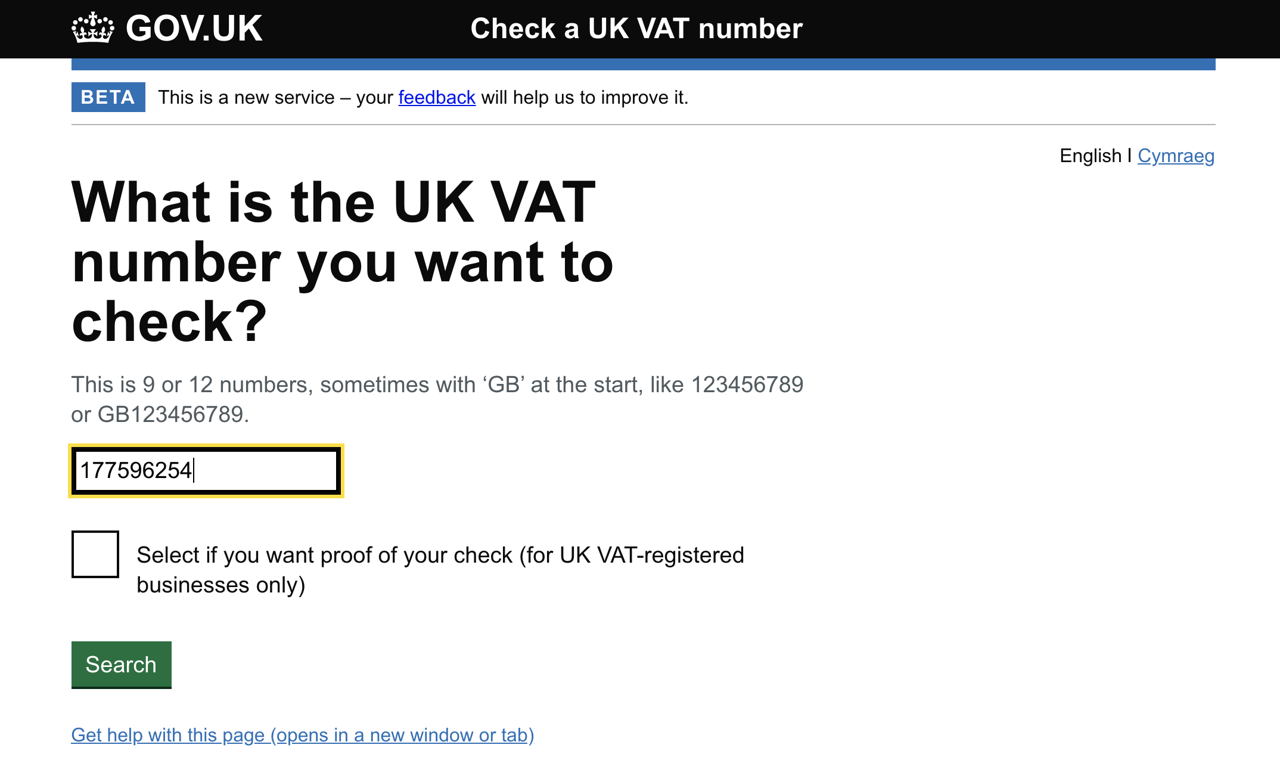

UK VAT numbers used to be validated through VIES. After Brexit, HMRC allows you to check and verify the business information of customers in the United Kingdom with their new service.. Check a VAT Identification Number. It's generally advised to check and validate all VAT ID numbers that you encounter in invoices. Even if there is a VAT.

UK VAT Number Validation Vatstack

How it works You can ask for the VAT registration number as the main heading or

of the screen. It may be a question or statement. Open this example in a new tab Display in Welsh What is.

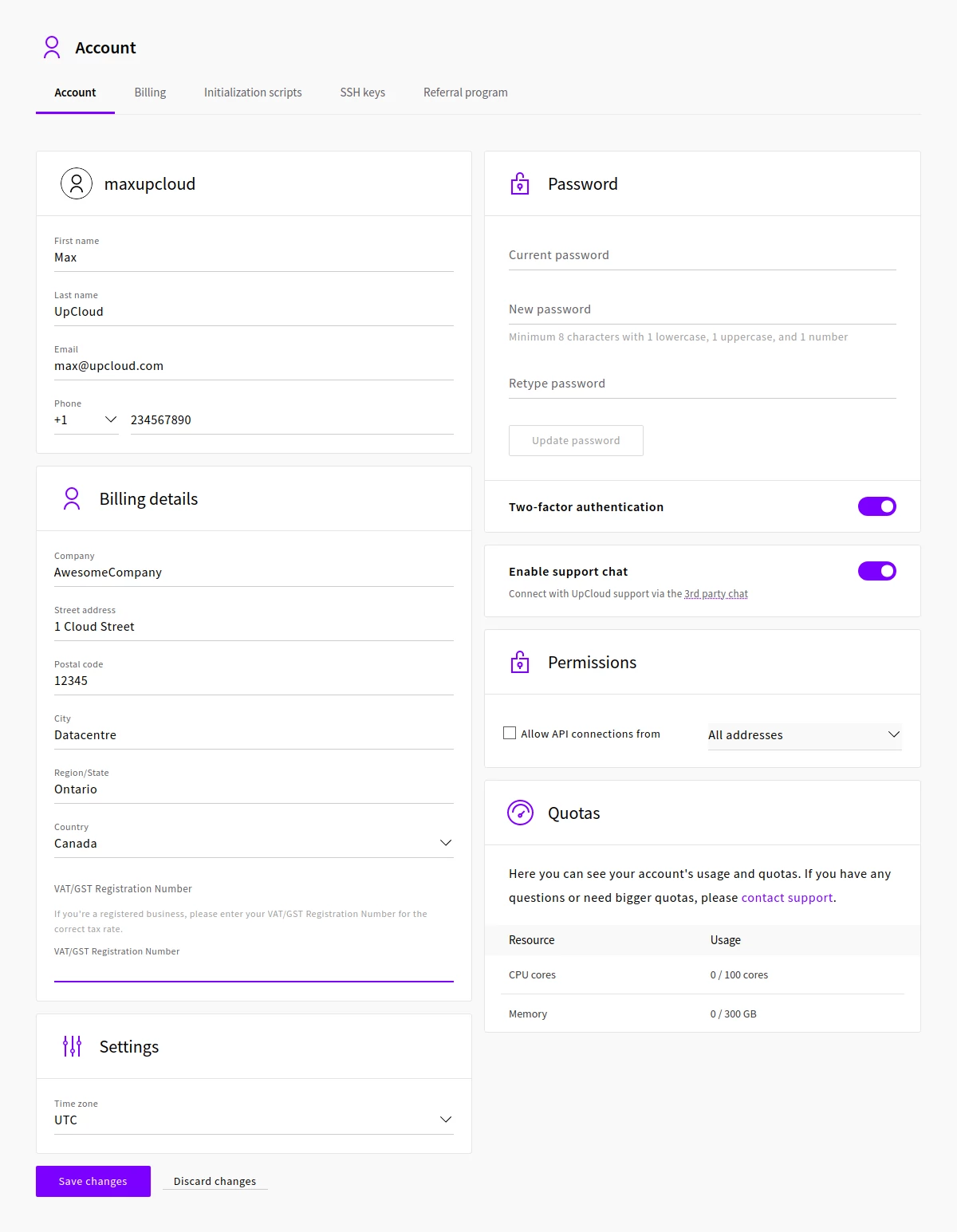

VAT and GST for international businesses UpCloud

A value-added tax identification number or VAT identification number ( VATIN [1]) is an identifier used in many countries, including the countries of the European Union, for value-added tax purposes. In the EU, a VAT identification number can be verified online at the EU's official VIES [2] website.

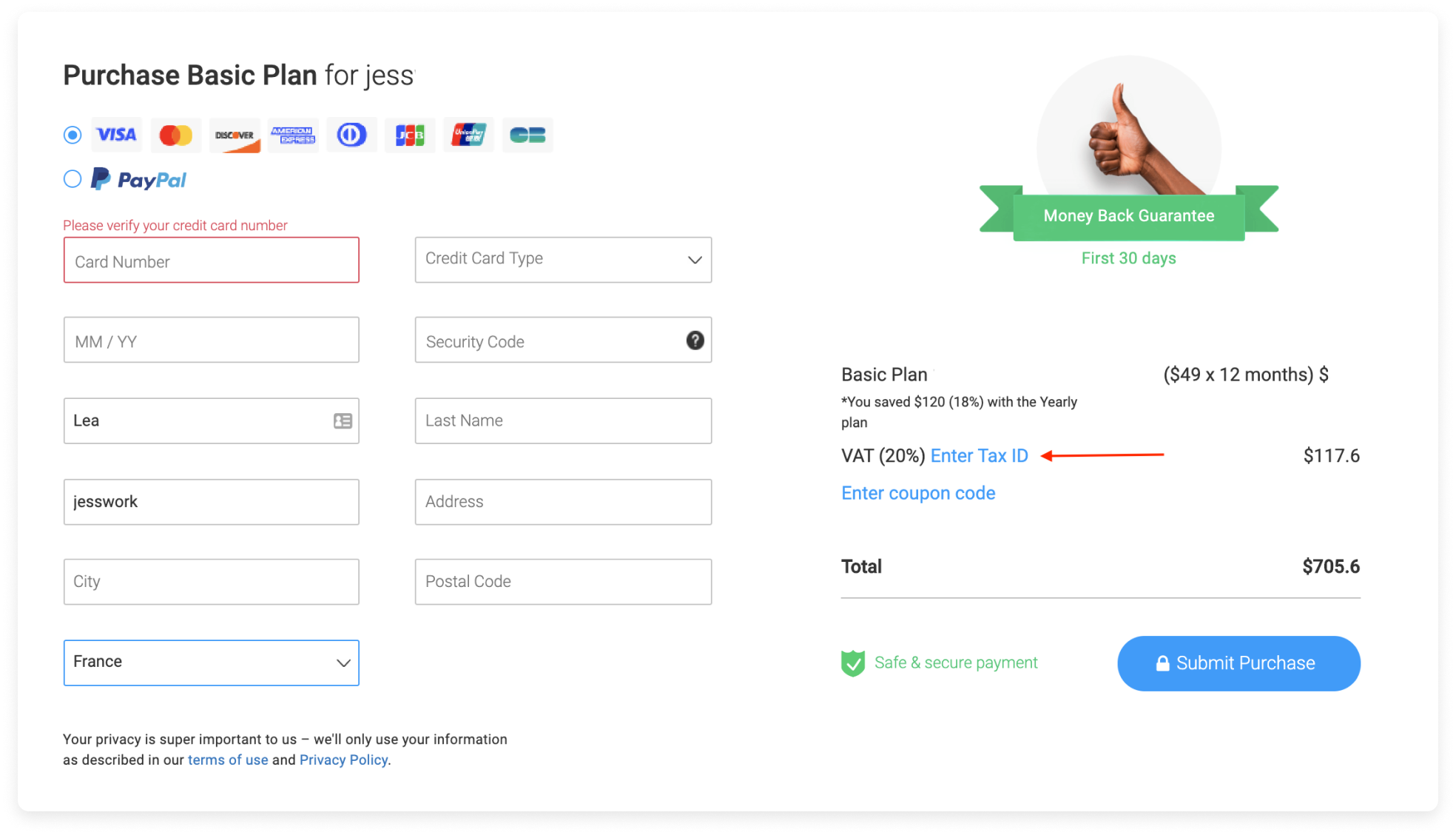

VAT When Paying for Wix Services in Europe Help Center

An example of a VRN that follows the UK VAT number format could be 'GB123456789'. If your business is located in Northern Ireland and you trade to the EU, you will use the prefix "XI" instead of GB. For example, XI123456789. A VAT number is a unique identification number that's assigned to every business registered for VAT.

How to Calculate VAT of UK in Tally 9 and its Accounting Treatment Accounting Education

Q1 - What is VIES (VAT Information Exchange System) on-the-web? Q2 - How is this information obtained? Q3 - Why do certain software suppliers ask for a VAT identification number when I purchase over the internet? Q4 - Information available on VIES on-the-web is not correct; how to correct it? Q5 - Can I make batch requests via VIES on the Web?

Validate Vat Registration and Tax Number 1 for EU countries SAP News

VAT Number ( VAT) For Entities, VAT, Example: GB723453785. The United Kingdom VAT number can be a 9-digit number, a 12-digit number followed by a 3-digit branch identifier, a 5-digit number for government departments (starting with GD) or a 5-digit number for health authorities (starting with HA). The 9-digit numbers use a weighted checksum.

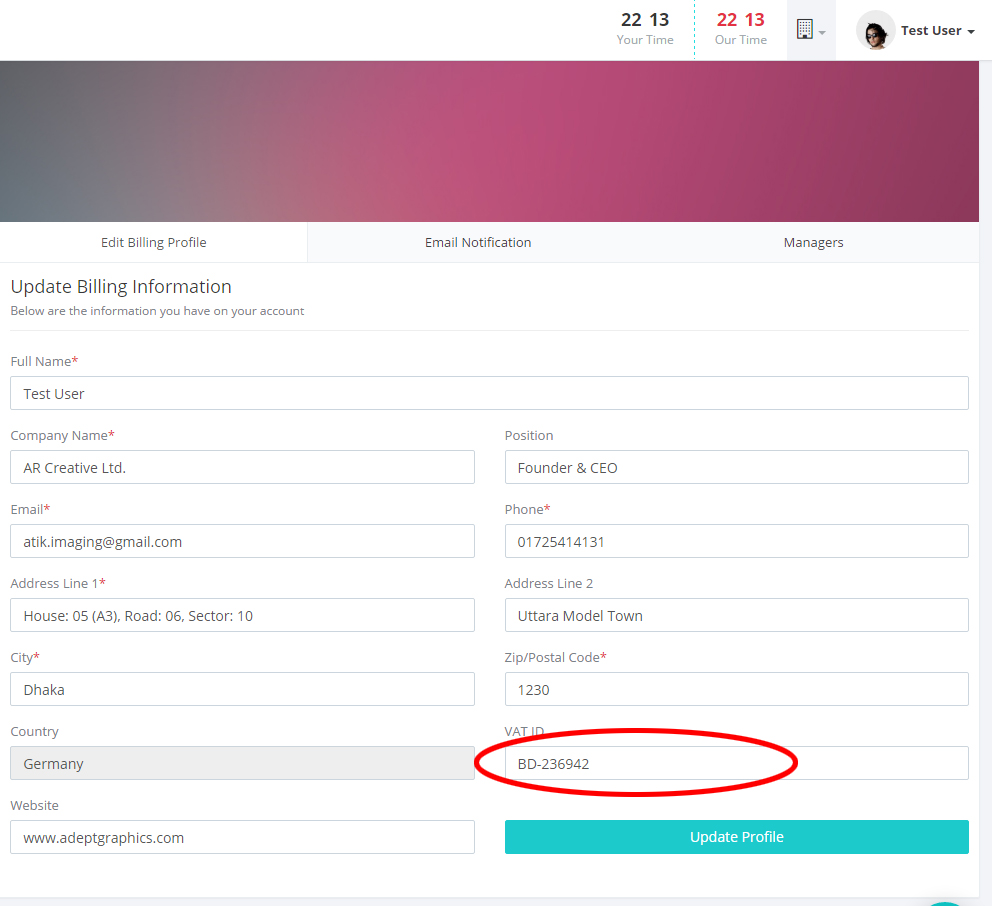

How to update my VAT ID number? Support

What is VIES? VIES (VAT Information Exchange System) is a search engine (not a database) owned by the European Commission. The data is retrieved from national VAT databases when a search is made from the VIES tool.

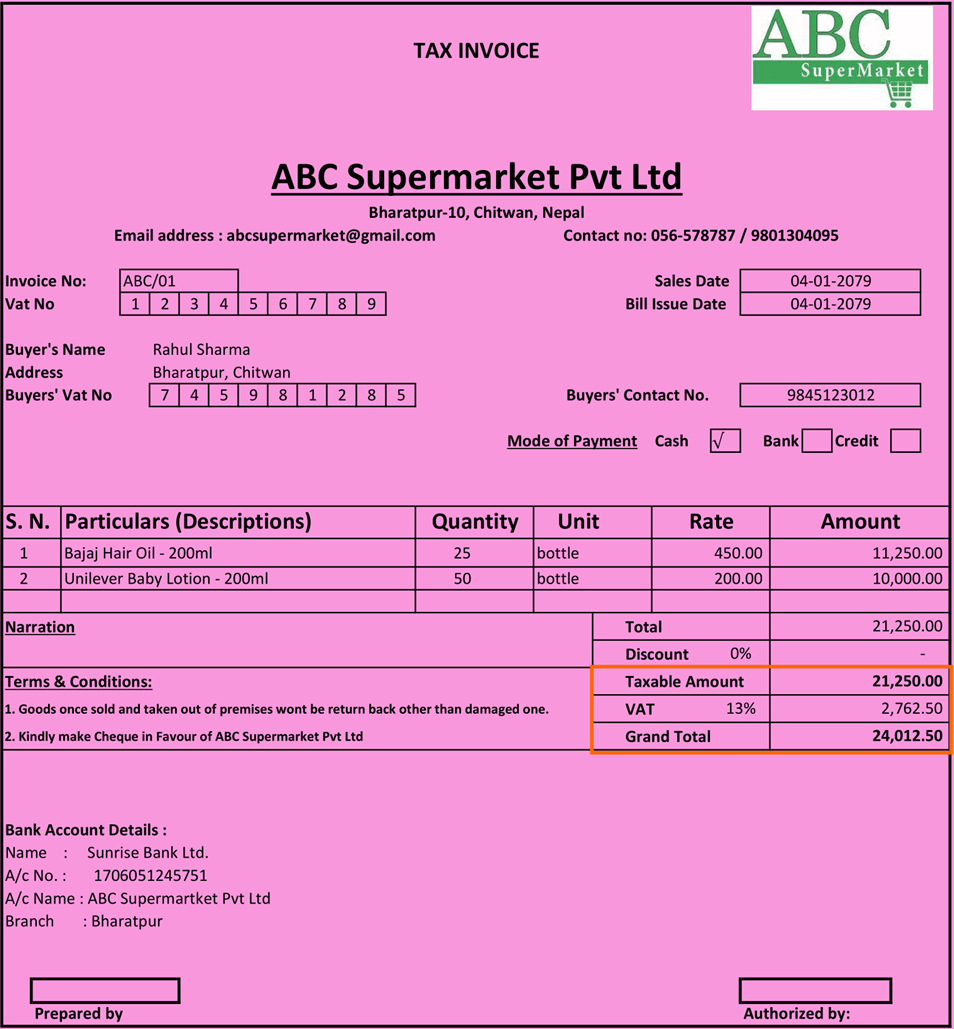

VAT (Value Added Tax) in Nepal Concept, Rules, Filing Returns

A VAT number is a unique ID that HMRC provides to businesses when they register for VAT. In the UK, VAT numbers are nine digits long and always have the prefix 'GB'. If you're dealing with a supplier in another EU country then its VAT number will follow a different format, with its own unique country code..

Can I Add My VAT ID on The Invoices?

A VAT-registered number is a unique identification issued to businesses that are registered to pay VAT.. A UK VAT number is nine (9) digits long, with two letters at the front indicating the country code of the registered business. For example, for Great Britain (UK), the first two digits of the VAT code are GB..

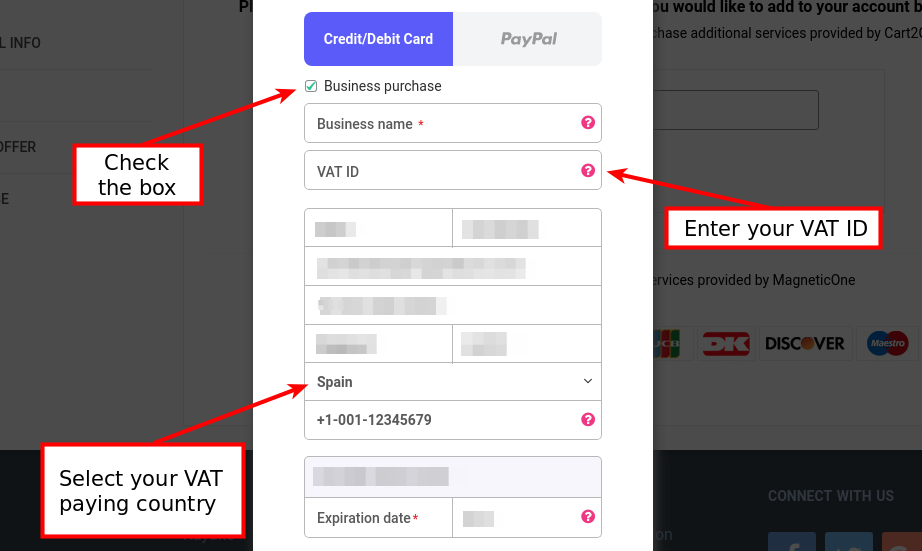

How to avoid paying VAT? Cart2Cart FAQ

The value added tax registration number (abbreviated 'VAT number', or 'VAT reg no.') is the individual identification number of companies that operate internationally within the EU. A VAT number enables international tax authorities to track and tax the transactions of these companies. A VAT identification number is crucial for all.

Handling VAT Identification No. and Group VAT ID AppVision Kft.

Below is a summary of the standard formats for each EU country, plus: Norway; Switzerland; and UK. EU VAT number formats Click for free EU VAT number formats i nfo Each EU member country has a slightly different format for their VAT number system, featuring a variation of numbers and letters.

2016 Form UK HMRC VAT1A Fill Online, Printable, Fillable, Blank pdfFiller

The VAT ID enables unique identification of all companies in the European Union. Anyone who wants to trade within Europe must register accordingly for this VAT ID. With the help of this number, your sales and expenses are recorded and thus serve as the basis for corresponding tax payments.

Handling VAT Identification No. and Group VAT ID AppVision Kft.

The format of the VAT identification number is defined in Article 215 of Council Directive 2006/112/EC on the common system of value added tax. Northern Ireland will .. 2 TCUIN number will be used to identify a 'UK without Northern Ireland' economic operator. Technically, TAXUD IT is ready for this scenario, but legally this scenario GB

Will I be charged tax on my purchases of FlippingBook products and services? FlippingBook

Antonia Klatt Last Updated on 6 September 2023 What is a VAT ID? The VAT Identification number identifies all companies in the European Union and is indispensable for intra-European trade. It can be obtained by registering vor VAT. When trading within the EU (intra-community supply/service) a VAT ID for making sure that taxes are paid is mandatory.